✨ Robotics, Ride-Sharing & Renewed Tariffs: Zimmer Biomet Innovates as Uber Accelerates

July 14, 2025

Good evening! Your financial compass for the day is here! 🧭

📰 Market Snapshot

It’s a tale of two markets. On one side, Trump-era tariff talk is back, rattling nerves with threats targeting Mexico, the EU, and even Russia. Investors are bracing for impact, but many are betting this is more political posturing than policy set in stone. Expectations are rising that cooler heads will prevail, leading to negotiation rather than escalation.

On the flip side, crypto is having a moment. Bitcoin just shattered past $120K, powered by booming ETF interest and the buzz around “Crypto Week” in Washington. Investors are flocking to digital assets not just for returns, but as a hedge in a landscape clouded by policy and inflation fog.

Meanwhile, the global economic picture is patchy. Singapore narrowly dodged a recession, but the road to recovery is still rocky. The Fed, for its part, remains stubbornly hawkish, keeping rates high despite mounting political pressure.

Add in stock-specific turbulence (Rivian’s tax-credit woes vs. AST SpaceMobile’s strategic wins), and you've got a market that’s equal parts anxiety and ambition. In short, cautious optimism rules the day, but buckle up, volatility isn’t going anywhere.

🔭 Key Focus Areas – What Investors Need to Watch

Tariff Tango: Trade tensions are heating up again with potential tariffs targeting Mexico and the EU. While some expect these measures to be softened through negotiation, the mere threat is rattling supply chains and investor nerves. Watch this space for deal diplomacy or economic fallout.

AI Everywhere: The AI arms race is far from over. Nvidia, Meta, and TSMC are pushing ahead with next-gen chips and infrastructure as investor capital continues to flow toward anything AI-tinted. The sector remains a magnet for both opportunity and geopolitical complexity.

Crypto Clarity Incoming?: With "Crypto Week" kicking off in Congress, the regulatory fog may start to lift. A favorable legislative tone could be a game-changer for Bitcoin, Ethereum, and the broader digital asset market.

EV Sector Shakeup: Rivian is under pressure from a loss of EV tax incentives, while GM is cutting costs with new battery tech. Tesla, meanwhile, might be cut from the U.K.'s charging subsidies. It’s a mixed bag of battery breakthroughs and policy roadblocks.

Economic Tea Leaves: Sluggish housing data, looming tariffs, and uneven global growth have investors eyeing key releases like inflation in India and GDP in Singapore for signs of strength… or stress.

⚖️ Policy Pulse

Trump Tariff Redux: A 15%-20% blanket tariff on imports is back on the table, risking higher prices, slower growth, and supply snarls. While some see it as a nudge toward domestic manufacturing, the near-term cost to consumers and businesses is hard to ignore.

Fed’s Poker Face: Despite political nudges, the Fed isn’t blinking. Rates remain high as inflation control takes precedence over rate cuts, keeping financial conditions tight.

China Plays the Long Game: Chinese exporters are re-routing shipments to non-U.S. markets to sidestep potential tariffs, highlighting Beijing’s adaptability and the global trade chessboard in motion.

Medical Debt Ruling Blocked: A Biden-era rule to wipe medical debt from credit reports has been halted by court order, good news for credit agencies, bad news for consumer advocates.

EV Mandate in Question: Rivian could take a $325M hit if Corporate Average Fuel Economy rules are rolled back. Combined with tariff threats, it’s a rough policy patch for EV startups.

🔍 Market Movers – Who’s Hot, Who’s Not

Coinbase Global, Inc. (COIN)

🟢 News Sentiment: 0.60

Coinbase Rides the Crypto Rocket

Coinbase is catching serious air as Bitcoin rockets past $120K, pushing daily trading volume on the platform up 34% to a staggering $61.36 billion. That’s not just good, it’s revenue gold for the leading U.S. crypto exchange.

Meme coins like Dogecoin (+21%) and Shiba Inu (+17%) are joining the party, adding fuel to the retail trading frenzy. And with "Crypto Week" kicking off in D.C., hopes are high that regulatory clarity could finally be on the horizon, a development that could draw in even more institutional money.

While some analysts remain cautious (as crypto rallies often invite corrections), the momentum is firmly on Coinbase’s side. It's a textbook case of being in the right place at the right (block)time.

Kenvue Inc. (KVUE)

🔴 News Sentiment: -0.60

Kenvue’s Boardroom Drama Spooks Investors

Kenvue, the consumer health heavyweight behind household names like Tylenol, just made a sharp pivot. CEO Thibaut Mongon is out, effective immediately. His abrupt firing, coupled with an active strategic review by the board, has investors raising eyebrows and asking tough questions.

Leadership shakeups like this are rarely smooth sailing. The sudden exit hints at deeper strategic or operational rifts, and the timing couldn’t be worse. With the board signaling potential course corrections, uncertainty now clouds Kenvue’s short-term outlook.

For investors, this move suggests turbulence ahead. Executive turnover often leads to shifting priorities, disrupted execution, and a “wait and see” period that markets rarely reward. Keep an eye on who takes the helm next, it’ll say a lot about where this ship is heading.

Salesforce, Inc. (CRM)

🔴 News Sentiment: -0.60

Salesforce Slips as Competitive Pressures Mount

Salesforce is feeling the heat. Down 23% year-to-date, the CRM titan is stumbling in a market it once dominated. Despite riding the pandemic-era digital wave and still holding a sizable chunk of the CRM pie, investor confidence is eroding fast.

Why? Fierce rivals like Microsoft and Oracle are closing in fast. The battle for market share is getting expensive, forcing Salesforce to pour more into R&D and marketing just to keep pace. That’s eating into margins while growth expectations remain unmet.

The company’s once-clear growth trajectory now looks murkier, and without a bold strategic reset, Salesforce risks falling further behind in a race it helped start.

Vistra Corp (VST)

🟢 News Sentiment: 0.60

Vistra Powers Up as AI Demand Sparks a Surge

Vistra is lighting up the market literally and figuratively. With a 40.6% stock rally in the first half of 2025, the energy player is proving it’s not just riding the AI wave, it’s fueling it.

By snapping up more power generation assets, Vistra is positioning itself as a critical supplier for the energy-hungry AI sector. That’s a smart move, turning surging electricity demand into a major growth engine. Even with macro headwinds like China’s Deep Seek release and trade war chatter in the background, Vistra’s momentum hasn’t flickered.

The market loves a well-executed growth story, and right now, Vistra looks like it's plugged into the future.

Uber Technologies, Inc. (UBER)

🟢 News Sentiment: 0.60

Uber Hits the Fast Lane with a 60% Surge

Uber’s not just getting people from A to B, it’s taking shareholders straight to the top. The stock has soared 60% year-to-date, leaving the S&P 500’s modest 6% gain in the rearview mirror.

Behind the wheel of this rally? Double-digit growth in both its mobility and delivery segments, fueled by strong consumer demand and razor-sharp execution. Uber’s secret sauce, its massive network and deep data moat, continues to create serious competitive advantages, from pricing power to personalized user experiences.

With efficient scaling and investor confidence riding high, Uber’s momentum is real, and it’s not slowing down anytime soon.

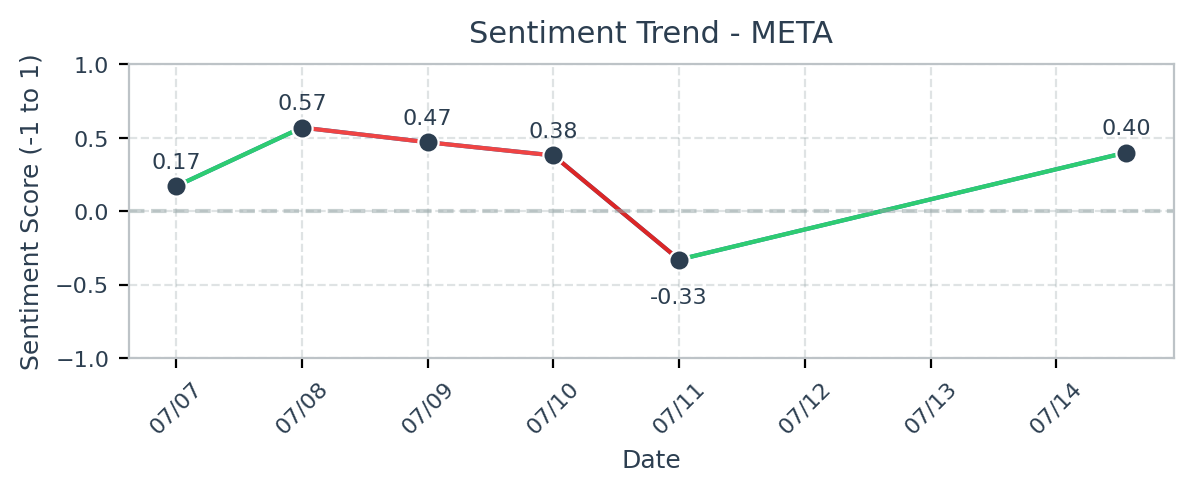

Meta Platforms, Inc. (META)

🔵 News Sentiment: 0.40

Meta Bets Big on AI and Then Bets Bigger

Mark Zuckerberg isn’t dipping his toe in the AI pool, he’s cannonballing in. Meta just pledged “hundreds of billions” toward building out AI infrastructure, including what could be the world’s first AI data supercluster by 2026. That’s not just a moonshot, it’s a galaxy-sized statement of intent.

With the acquisition of voice AI startup PlayAI and a full-court press on top AI talent, Meta is stacking the deck to lead in everything from digital assistants to AI-powered wearables. The strategy is bold, costly, and unapologetically long-term.

Yes, it’s a heavy lift now, but the payoff could be transformational. Meta is clearly betting that whoever dominates AI, dominates the next decade, and they plan to be first in line.

General Motors Company (GM)

🔵 News Sentiment: 0.40

GM Supercharges Its EV Strategy with a Battery Boost

General Motors is dialing up its EV game with a strategic upgrade to its Spring Hill, Tennessee plant, thanks to its Ultium Cells joint venture with LG Energy. The goal? Make EV batteries cheaper, faster, and at scale.

By slashing battery costs, GM is tackling one of the biggest roadblocks to EV adoption head-on. More affordable batteries mean more affordable cars, which could supercharge demand and expand GM’s slice of the EV pie. Plus, domestic production gives it a leg up in reliability and possibly some policy perks, too.

It’s a smart, forward-looking move that strengthens GM’s competitive footing and signals it’s in the EV race for the long haul.

ASML Holding N.V. (ASML)

🔵 News Sentiment: 0.30

ASML Stays in the Semiconductor Spotlight

ASML isn’t just riding the semiconductor wave, it’s helping build it. Featured alongside giants like Nvidia and AMD, ASML’s lithography tech is clearly in high demand, and investors are paying attention.

Its equipment powers the chips driving AI, data centers, and next-gen computing, making it the unsung hero behind some of the market’s biggest stories. Even without flashy headlines, the company’s consistent inclusion in analyst discussions signals quiet confidence in its long-term relevance.

If the chip boom continues (and all signs say it will), ASML looks well-positioned to keep cashing in - no spotlight needed.

Alphabet Inc. (GOOGL, GOOG)

🟡 News Sentiment: -0.30

Alphabet Feels the Heat in the AI Arms Race

Alphabet may still rule search for now, but challengers are closing in. Rising stars like OpenAI and Perplexity are developing smarter, sleeker AI-driven alternatives, and that’s got investors watching closely. Search advertising is Alphabet’s cash cow, and any threat to that moat is a serious concern.

On the bright side, Google Cloud is holding its own. A 21% bump in Q1 cloud spending helped boost its market share, and new developer tools from Nokia joining the Cloud Marketplace suggest steady traction in the enterprise space.

Still, the good cloud news can’t fully offset the looming risks in search. If Alphabet wants to stay on top, it’ll need to innovate fast or risk falling behind in a game it used to dominate.

Advanced Micro Devices, Inc. (AMD)

🔵 News Sentiment: 0.30

AMD Rides TSMC Tailwinds Toward Growth

AMD may not be making headlines this week, but it’s quietly gaining momentum, thanks to its powerhouse partner, TSMC. While details are thin, updates from the chip foundry giant point to manufacturing gains that could translate into lower costs, higher volumes, and faster innovation for AMD.

With demand booming in CPU and GPU markets, every efficiency counts. TSMC’s progress gives AMD the production muscle it needs to stay competitive with Intel and Nvidia and maybe even outpace them.

It’s not flashy, but it’s foundational. And for AMD investors, that’s a win worth watching.

Visa Inc. (V)

🟡 News Sentiment: -0.30

Visa Faces Near-Term Headwinds Despite Long-Term Promise

Visa might have its sights set on a $2 trillion market cap by 2035, but the road ahead is looking bumpier in the short term. The rise of stablecoins is starting to chip away at Visa’s dominance in payment processing, posing a direct threat to its core business model.

Layer on the uncertainty from Trump-era tariff threats, and you've got a recipe for potential slowdowns in global trade and consumer spending, two pillars Visa relies on for transaction volume.

The long-term story is still compelling, but near-term investors should keep a close eye on how Visa navigates this new world of digital currency and geopolitical tension.

Phreesia, Inc. (PHR)

🟡 News Sentiment: -0.30

Phreesia Hits a Rough Patch as Analyst Confidence Wavers

Phreesia may still be paddling, but the current just got stronger. A recent downgrade from SVB Leerink from “Outperform” to “Market Perform” signals growing caution around the company’s growth prospects. While it had support from both SVB and Raymond James as recently as late 2021, that sentiment seems to be cooling.

The downgrade didn’t come with detailed reasoning, which leaves investors guessing, but the message is clear: expectations have been dialed back.

It’s not a red flag yet, but it’s definitely a yellow one. Phreesia will need to deliver clarity and performance to regain analyst enthusiasm and investor trust.

Waters Corporation (WAT)

🟡 News Sentiment: -0.20

Waters Wades Through Choppy Market Waters

Waters Corporation isn’t making waves for the right reasons. While it showed up on a list of “biggest movers,” the context wasn’t exactly celebratory; there’s little substance behind the shift, and the broader market narrative isn’t helping.

With looming tariff threats stirring global trade jitters, companies like Waters, reliant on international sales and supply chains, could find themselves caught in the crossfire. Add to that a noticeable absence of fresh, positive catalysts, and the near-term outlook looks tepid at best.

For now, Waters seems to be drifting without a clear current. Investors may want to keep a cautious eye on the horizon.

Johnson & Johnson (JNJ)

🟡 News Sentiment: -0.20

Johnson & Johnson: Losing a Major Vote of Confidence

Johnson & Johnson just got a not-so-subtle nudge from one of its investors, Andrew Hill Investment Advisors pulled the plug on their entire $6.31 million stake. While a single exit doesn’t spell doom, reallocating 5.1% of their portfolio sends a clear message: they see better opportunities elsewhere.

This move suggests growing skepticism around JNJ’s near-term potential. Whether it’s competitive pressures, sluggish growth prospects, or just plain portfolio repositioning, it’s enough to raise an eyebrow. When a major investor walks away entirely, others often start asking why.

For now, it’s less about drama and more about direction JNJ may need to prove it still belongs in the big leagues.

UnitedHealth Group Inc. (UNH)

🟡 News Sentiment: -0.20

UnitedHealth Group: Taking a Small Step Back

UnitedHealth just saw a notable fund hit the brakes. Ferguson Wellman sold off nearly $60 million worth of shares, trimming their stake by about 1% of their portfolio. While this isn’t a full-blown exit, it signals a subtle shift in sentiment or strategy, with the fund reallocating capital to potentially higher-growth opportunities elsewhere.

Given UNH’s massive market cap, this sale might not rock the boat too much, but it’s a nudge worth noticing. When big players adjust their bets, others tend to take note and sometimes follow suit. For now, UnitedHealth faces a mild headwind as investors recalibrate their expectations.

HDFC Bank Limited (HDB)

🟡 News Sentiment: -0.20

HDFC Bank: Sailing into Stormy Seas

Myriad Asset Management just jumped ship, completely divesting its $3.29 million stake in HDFC Bank. While this represents a small slice of their overall portfolio (2.2%), a full exit sends a pretty clear message: doubts about HDFC’s near-term prospects or a strategic pivot away from the bank’s market.

When an institutional investor goes all in on a sell-off, it tends to rattle nerves and could invite more selling pressure. So, watch this space, HDFC Bank might be facing some rough waters ahead as sentiment takes a hit.

Block, Inc. (SQ)

🟡 News Sentiment: -0.20

Block, Inc.: Riding Out the Rainy Days

Block’s weathering some unexpected storm clouds, though not from its own operations, but from Bill Ackman’s high-profile spat. Since Ackman’s Pershing Square is a major Block stakeholder, the controversy swirling around him adds a dash of reputational risk for Block’s stock.

Even if the dust settles fast, this kind of headline drama can rattle investor confidence and stir short-term volatility. It’s a reminder that when a heavyweight investor gets spotlighted for all the wrong reasons, companies in their orbit can feel the ripple effects. For now, Block’s got to keep its ship steady and its ethics sharp to avoid any stormy waters ahead.

Canaan Inc. (CAN)

🔵 News Sentiment: 0.20

Canaan Inc.: Quietly Climbing the Charts

Canaan might not be grabbing headlines with flashy announcements, but the stock is steadily moving in the right direction. Grouped with other big names showing upward momentum, it’s clear investors are giving Canaan a nod of approval, whether that’s due to market tailwinds or solid underlying business isn’t spelled out, but the vibe is positive.

No red flags or drama in sight, just a calm, steady climb that suggests confidence is building quietly. Sometimes the slow and steady approach is the smartest play. Keep an eye on Canaan as it inches forward with subtle strength.

Wolfspeed, Inc. (WOLF)

🔵 News Sentiment: 0.20

Wolfspeed, Inc.: Steady Gains Amid the Waves 🔵↗️

Wolfspeed is cruising ahead with a solid 12.3% share price jump in just a week, not bad considering the choppy waters of market volatility. Investors seem to like the company’s strong footing in silicon carbide tech, a space with big growth potential.

Adding to the good vibes, Wolfspeed just brought on a new CFO, signaling fresh financial leadership and maybe a sharper strategic focus. While details on the new CFO are still under wraps, a leadership change often hints at a company gearing up to tighten the reins and drive smarter growth.

Sure, the stock had its ups and downs during the week, reminding us that it’s not all smooth sailing, but the overall tone is optimistic. Wolfspeed’s steady moves suggest it’s ready to ride out the waves while aiming for bigger horizons.

Amazon.com, Inc. (AMZN)

🔵 News Sentiment: 0.40

Amazon: Coding the Future with AI and E-Commerce Muscle 🟡

Amazon isn’t just resting on its $2 trillion laurels, it’s charging full steam ahead with AI. AWS just dropped Kiro, an AI-powered coding assistant aimed at developers, staking its claim in the hotly contested AI tooling arena. This move isn’t just flashy; it’s a smart play to deepen AWS’s ecosystem and boost long-term revenue as AI-driven development takes off.

Meanwhile, Amazon’s e-commerce dominance remains rock solid. Procter & Gamble is actually losing market share on Amazon’s platform, showing just how powerful Amazon’s retail influence is. It’s the place to be if you want to sell and buy, and Amazon’s grip on consumer behavior only tightens.

With a spot in the exclusive $2 trillion club alongside tech giants like Nvidia and Microsoft, Amazon’s future looks promising. Investors can take this as a sign of a company not only leading today’s markets but also innovating aggressively for tomorrow. The big question: Is buying Amazon stock today the ticket to setting yourself up for life? Given its AI ambitions and market muscle, the outlook sure feels that way.

Kraft Heinz Company (KHC)

🔴 News Sentiment: -0.60

Kraft Heinz: Is Berkshire Getting Cold Feet?

Whispers are swirling around Kraft Heinz, and they’re not exactly sweet. Rumors of a possible breakup have investors nervously eyeing Berkshire Hathaway’s next move, because if Warren Buffett’s firm starts selling off its stake, we could see a hefty shakeup in the stock price.

This isn’t just gossip; a major shareholder’s hesitation often signals deeper issues, maybe internal clashes or strategic misfires, that could hamper Kraft Heinz’s growth story. While details remain murky, the mere buzz has put a bit of a cloud over the company’s outlook.

Investors should keep their radar on Berkshire’s actions and these breakup rumors because if the sell-off kicks in, Kraft Heinz might face a rough patch ahead. For now, it’s a wait-and-watch game - but the stakes are high.

Rivian Automotive, Inc. (RIVN)

🟡 News Sentiment: -0.40

Rivian: Riding Through Rough Roads

Analysts at Guggenheim are waving caution flags for Rivian, predicting a slowdown in sales that’s only getting trickier with the loss of key tax credits. The combo could weigh heavily on Rivian’s stock, casting a shadow over what’s been a bumpy journey so far.

Add to that a potential $325 million revenue hit from relaxed CAFE regulations and the looming uncertainty around Trump-era tariffs, it’s clear the road ahead isn’t exactly smooth. While Rivian keeps popping up in market chatter and analyst calls, the sentiment leans cautious, with investors advised to keep a close eye on sales and any fresh financial headwinds.

In short, Rivian’s facing some headwinds that could stall its growth engine, a situation worth watching closely if you’re holding the wheel here.

Workhorse Group Inc. (WKHS)

🔴 News Sentiment: -0.60

Workhorse Group: In Merger Talks, but the Road Looks Rocky

Workhorse is currently deep in talks for a potential merger with a mysterious private EV player, a move that might sound promising but also sets off alarm bells. This isn’t your run-of-the-mill growth strategy; it’s a sign that Workhorse could be wrestling with some financial or operational struggles, looking for a lifeline.

Add in refinancing plans and a brand-new subsidiary popping up as part of the mix, and you’ve got a complex puzzle with plenty of moving parts, none of which are guaranteed to pan out smoothly. For investors, this means uncertainty, potential dilution, and a strategic pivot that could shake up shareholder value.

Bottom line: While a merger could breathe new life into Workhorse, it’s also a red flag waving for caution. Keep a close watch, this ride could get bumpy before it gets better.

Zimmer Biomet Holdings, Inc. (ZBH)

🟢 News Sentiment: 0.60

Zimmer Biomet: Robotics Upgrade Ahead!

Zimmer Biomet is stepping up its game by acquiring Monogram Orthopedics and folding its robotic knee system into the ROSA platform. This isn’t just a tidy little add-on, it’s a smart play to dominate the booming orthopedic robotics arena, where precision and minimally invasive tech are the name of the game.

With a clear roadmap to grow and innovate through 2027, Zimmer is signaling serious long-term ambition. Plus, bringing AI tech into the mix only sweetens the deal, promising smoother surgeries and happier patients, which, of course, means more hospitals and surgeons knocking on their door.

Bottom line: Zimmer Biomet’s move positions them as a heavyweight contender in orthopedic robotics, with solid growth and innovation baked right in. Investors should keep this one on their radar.

NIO Inc. (NIO)

🔵 News Sentiment: 0.40

Nio Inc.: Charging Ahead with the Onvo L90

Nio’s stock is revving up, cruising higher thanks to the buzz around the recent pre-order launch of their sleek new Onvo L90. Investors are clearly liking what they see, a fresh model that could spark stronger sales and juice revenue growth.

The positive market reaction reflects solid demand and growing confidence in Nio’s place in the fiercely competitive EV race. While broader economic and political noise buzzes in the background, it’s Nio’s product momentum that’s taking center stage.

Bottom line: With the Onvo L90 firing on all cylinders, Nio looks poised to keep its charge going strong, attracting investors and expanding its EV footprint. Keep this one in your fast lane!

📅 Coming Up

Earnings Watch: Key reports dropping this week. Expect movement as Wall Street digests updated guidance and macro commentary.

Crypto Week in Congress: Could reshape the regulatory landscape for digital assets.

India Inflation Data: June’s numbers are coming, global investors are watching.

Singapore Q2 GDP: Will the data confirm slowdown fears or surprise to the upside?

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.